Bitsoft 360

Don’t get scammed by websites pretending to be Bitsoft 360. Register your official Bitsoft 360 account through Dex.ag and receive a FREE Personal Account Manager to help you with the setup process.

Official Bitsoft 360 Registration

It is claimed by the Bitsoft360 platform that its proprietary cryptocurrency trading application is powered by artificial intelligence (AI). Our analysis of Bitsoft360 investigates these claims and the primary capabilities highlighted on the Bitsoft360 website. Traders must research Bitsoft 360 and always remember that trading generally involves some risk.

Let’s find out what services Bitsoft360 provides, how much it costs, and how to sign up for it.

The Pros and Cons of Bitsoft 360

Bitsoft 360

Discover the world of Bitsoft 360's capabilities! Unveil an innovative trading platform where cryptocurrencies, stocks, and more converge. Experience the power of demo mode before active trading, backed by an 85% success rate and automated deals. Manage volatility with precision, all underpinned by our unwavering 100% platform availability. Join us to explore Bitsoft 360's global trading advantages.

Price: 250

Price Currency: USD

Operating System: Web-based, Windows 10, Windows 7, Windows 8, OSX, macOS, iOS, Android 7.1.2, Android 8.1, Android 9.0, Android 10.0, Android 11.0, Android 12.0, Android 13.0

Application Category: Finance Application

4.96

Pros

- Bitsoft 360 has a demo mode.

- Trade cryptocurrencies in addition to stocks, foreign exchange, and CFDs.

- SLA for 100% Platform Availability

- 85% Trade Win Rate

- Trades & Operates 24/7

- Market Volatility Management

Cons

- Not available in all regions at this time

- No Mobile App

BitSoft 360 Trading Platform Overview

When selecting a trading bot, you will have access to a wide variety of trading assistance products to choose from. Users of the Bitsoft 360 trading system have access to an impressive assortment of useful tools and functions. When you first embark on your trading journey, it would be good to consider using Bitsoft 360 as your trading platform. Below, we have outlined a few points that make this possible. Find out below what distinguishes using Bitsoft 360 from any other trading software available today.

Place Trades Simultaneously

Because Bitsoft 360 executes trades on your behalf, a sophisticated algorithm and the application of artificial intelligence make it possible for multiple trades to take place simultaneously. The software’s time-saving function of the trading robot is a significant benefit.

Trading with emotional bias

As was mentioned earlier, Bitsoft 360 is a fully computerized trading robot. This means the possibility of making a mistake due to human error has been removed from the trading process. This ensures that trading on the cryptocurrency market is conducted without being influenced by emotions or impulses, making it safe to trade.

Free of Charge for Licensing

Bitsoft 360 will not charge you any licensing fees; the only fee that you are required to pay is a minimum deposit of 250 Euros, which will also serve as your trading capital for your first few trades.

Trade Multiple Cryptocurrencies

Bitsoft 360 can trade with various cryptocurrencies, ranging from the most common ones, like Bitcoin, to other cryptocurrencies, considered more unique.

| 🤖 Robot Type: | Trading Robot |

| 🔑 Official Quantum AI website? | N/A |

| 💸 Minimum Deposit: | $250 |

| 🚀 Claimed Win Rate: | 90% |

| 💰 Trading Fees: | Small commission on profits |

| 💰 Account Fees: | $0 |

| 💰 Deposit/Withdrawal Fees: | $0 |

| 💰 Software cost: | $0 |

| ⌛ Withdrawal Timeframe: | 24 Hours |

| 💲 Supported Fiats: | USD, EUR, GBP |

| 💱 Trading Forex | Unavailable |

| 📊 Leverage: | 5000:1 |

| 📱 Native Mobile App: | No |

| 🖥️ Free Demo Account: | Yes |

| 🎧 Customer Support: | Contact form, Email, Phone |

| ✅ Verification required: | KYC |

| 🔁 Automated Trading: | Yes |

| 📈 CFD Available | Yes |

Free Trial Account

This automated trading platform is fantastic for several reasons, one of which is that it allows users to practice using the trading account through a demo account. Beginners have the opportunity to become accustomed to auto trading before making significant financial commitments thanks to Bitsoft 360’s provision of a demo account for its users. Before moving on to live trading, we strongly suggest using the demo account as a training ground to learn new trading strategies, This way, you can practise whatever you learn from online or offline courses in a safe space.

What is BitSoft360?

Bitsoft360 is a cryptocurrency trading robot that aims to assist traders of all experience levels in improving their trading decisions through increased market knowledge. The programming analyzes the market with the help of crypto trading signals, and then it generates profitable trading decisions based on both short-term and long-term market movements. Traders can use Bitsoft360 to invest in over 10,000 different cryptocurrencies, including Bitcoin, Ethereum, XRP, and Solana, as well as the most well-known cryptocurrencies such as these.

We have no choice but to concede that the Bitsof360 trading software is uncomplicated and intuitive, making it an excellent choice for all types of traders regardless of their level of expertise and education. Because cryptocurrency is significantly more volatile than most stocks, it is essential to use an automated trading platform such as Bitsoft360.com to protect your investments from overnight losses.

Bitsoft360 is an essential Bitcoin and cryptocurrency trading program that provides users with a trading environment that is both safer and more accurate. Over more than six years, it has solidified its position as one of the most reputable Bitcoin trading platforms within the crypto community. It is a less complicated approach to safeguarding your trades and portfolio, and the functionality for registering and logging in is streamlined and straightforward.

Regardless of how much time you spend on the platform daily, the software will simplify and improve the trading experience because it was developed with those goals in mind. It should not be a surprise that the quality of the outcomes will directly correlate to the amount of time and effort invested.

Bitsoft360 provides available customer service around the clock and a one-on-one private account manager who will guide you through registering for the service. You can contact their support staff in various languages anytime or night by completing the contact form on their website or logging in to your account. You can access your account after logging in on the page.

The user experience offered by Bitsoft360 was developed to simplify its software for traders of all kinds.

BitSoft360 Key Features

Fast Trading

Another important aspect of the Bitsoft360 platform is its lightning-fast trading system to complete trades. The developers claim that the Bitsoft360 platform can make decisions in a matter of microseconds as soon as it recognizes patterns in the market. This indicates that traders can maximize their profits using the high-speed trading system.

However, the developers of Bitsoft360 have not yet revealed detailed information regarding this system’s operation.

Claimed High Success Rate

Your Bitsoft 360 trading account will monitor the state of the cryptocurrency market and will make trading decisions on your behalf, so you won’t need to be an expert to make substantial profits successfully.

Demo Trading

One of the features that make Bitsoft360 useful for both novice traders and seasoned professionals is the platform’s ability to function as a demo account. Beginners will be able to use the account to get a feel of how the platform operates, while more seasoned traders will be able to put their trading strategies through their paces before putting them into action during live trading.

According to the developers of Bitsoft360, this can significantly increase traders’ chances of making a profit.

Instant Deposits and Withdrawals

When you engage in trading with Bitsoft 360, once you have finished filling out your withdrawal form, you will be able to make withdrawals within 24 hours using the payment method of your choice for your convenience.

How Does BitSoft360 Work?

Fees

The payment structure of any service that traders use is an essential component of that service. The developers of Bitsoft360 have implemented an intriguing new fee structure, and traders may be interested in learning more about it. Have a look at it down here:

- There are no fees associated with the transactions.

- There are no commissions charged for trading.

- There are no fees for maintaining your account.

- No hidden charges

| Account Opening Fee | N/A |

| Commissions | 0.01% |

| Annual Fee or Membership Fee | N/A |

| Inactivity Fee | N/A |

| Maintenance fee | N/A |

| Transaction fee | N/A |

| Withdrawal Fee | N/A |

Even if traders make money using Bitsoft360, the company will not charge them any commission. The table evidences this. Traders should be aware, however, that brokers associated with Bitsoft360 may charge fees in exchange for their services.

Automation

The cryptocurrency trading bot that was just discussed does not require you to know coding for you to use it, in contrast to other auto-trading bots. Have no fear; you will quickly pick up the skills necessary to use it.

Also, you should know that machine learning is the foundation of trade automation. Let’s not overlook the importance of mathematical algorithms, either. Bitsoft360 can analyze the current market conditions and trading signals relatively quickly.

Minimum Deposit

The provision of trading services often involves the requirement of minimum deposits. The minimum deposit required to use Bitsoft360 is $250, which is on par with the requirements for many other trading platforms of a similar size.

Because of the significant volatility associated with cryptocurrencies, traders should always set a stop loss before engaging in transactions involving these assets. To put this another way, you should begin with the absolute bare necessities and work your way up. In addition, it is strongly recommended that investors trade with only the amount they can afford to lose.

Security

It does not matter how beneficial a service seems to be if there is a consistent possibility that it will steal your money or hold it hostage. It is not worth the risk. This is a significant problem in the cryptocurrency industry, as con artists from virtually every other financial sector appear to have made it their nexus. There are no regulations in most locations, and even in those where legislation does exist, the regulations are lax.

Because of this, when you trade with crypto companies, you frequently operate in an ambiguous legal space. Your safety will depend on the research you do on your own, as well as their past and goodwill. Some indicators can be used to judge the level of safety a cryptographic service provides, even though this is not always an easy task. Even so, there is still a chance that market participants are unaware of them, which is why we are here to assist.

We investigated the company’s claims and practices as part of the research we did for this review of Bitsoft360. To our great relief, we did not discover anything that would cause significant cause for concern. Based on its actions and general tendencies, we can confidently say that Bitsoft360 is one of the more secure cryptocurrency services.

The initial price barrier is only $250, which is quite manageable. Scammers operating in the cryptocurrency space are targeting significantly higher numbers. Because crypto is based on the internet, a word about scammers spreads quickly, resulting in a short life span of fraudulent behaviour. Swindlers demand greater sums of money so that they can make the most of the limited amount of time they have.

In addition, we found that Bitsoft360 is prepared to provide evidence supporting each claim it makes. Due to the absence of any consequences for spreading false information. It is reassuring that Bitsoft360 is forthright and data-based in its approach.

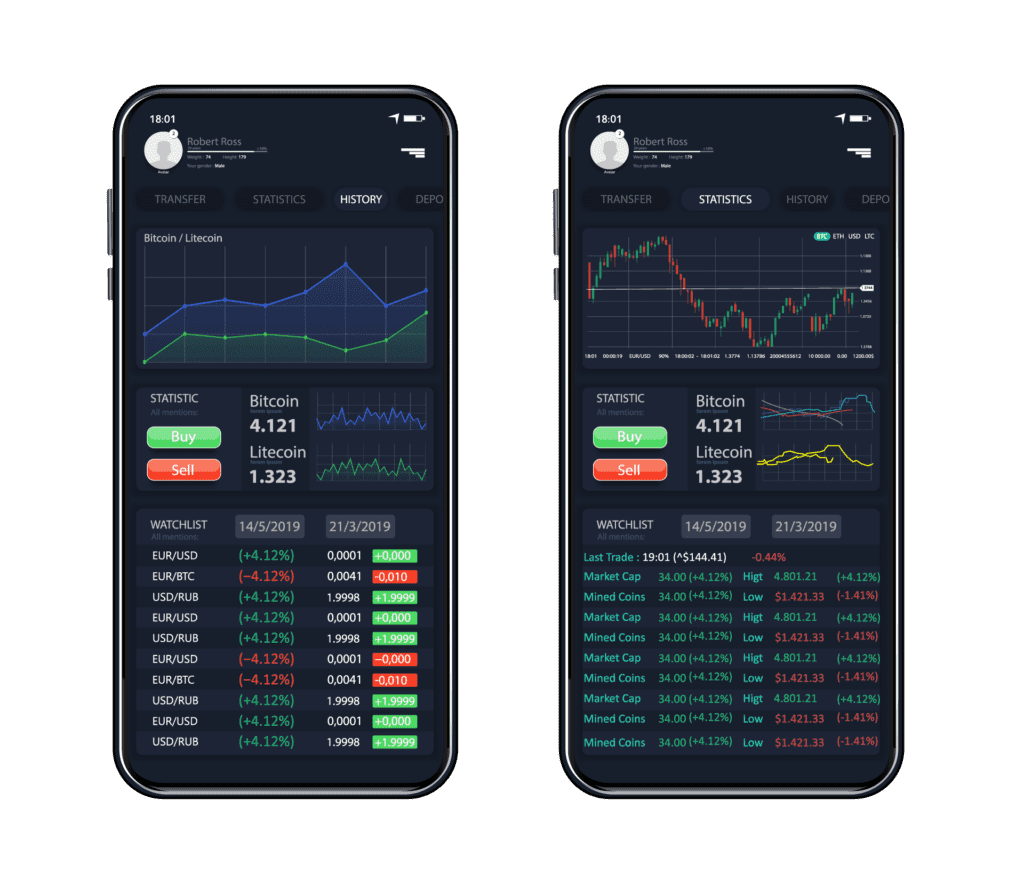

Interface

Bitsoft 360 was developed to simplify your life, and as a result, its interface has been developed to be as straightforward to use as humanly possible. From the simple web design to the colours etc., everything is simple and intuitive.

Customer Support

As mentioned earlier, the developers of Bitsoft360 have asserted that their company provides a trustworthy customer support system for traders who need assistance. On the other hand, they have not disclosed any information about this system up to this point. The traders will be required to conduct a Bitsoft360 test to validate the accessibility of the purportedly reliable customer support system.

Methods of Withdrawing

Traders want the ability to fund their accounts with various payment methods. Because of this, they can evaluate the costs associated with the various methods and select the most appropriate course of action. On the Bitsoft360 website, you can make payments with Visa, GPay, or Mastercard.

Demo Account

One of the features that make Bitsoft360 useful for both novice traders and seasoned professionals is the platform’s ability to function as a demo account. Beginners will be able to use the account to get a feel for how the platform operates, while more seasoned traders will be able to put their trading strategies through their paces before putting them into action during live trading.

According to the developers of Bitsoft360, this can significantly increase traders’ chances of making a profit.

Asset Variety

One of the reasons that forex traders favor forex brokers that offer a wide variety of currency pairs is that they can find potential trades during periods in which the major currencies are trading sideways. Bitsoft360 claims that it can search the market for major cryptocurrencies like Bitcoin, Ethereum, Solana, and Dogecoin, in addition to 16,000 other cryptocurrencies.

Traders now have more opportunities to have open positions and potentially profit from those positions as a result of this.

BitSoft360 Scam or Legit?

Because technological advancement is occurring rapidly, you will have abundant choices when searching for an appropriate crypto trading platform that meets your requirements. The options are endless due to the rapid pace of technological advancement. It can get overwhelming when you consider the sheer number of different trading platforms, and it can be even more challenging to figure out which one you should trust to do your trading. You could be wondering if Bitsoft 360 is a scam or if it’s a legitimate business. We can see that Bitsoft 360 is not a fraudulent enterprise but a secure and legitimate trading platform.

It is not surprising that, given the prevalence of fraud in the world today, it can be difficult to determine who can be trusted and who is perpetrating a con. When it comes to Bitsoft 360, you can be certain that the trading software you use is legitimate. This gives you peace of mind. Bitsoft 360 has formed a partnership with brokers that are licensed by CySEC so that they can assist you in managing your account. Your confidentiality is highly important to us; for this reason, this trading platform uses SSL certificates to encrypt all of your personally identifiable information (PII).

Even when someone else handles the trading on your behalf, dealing with cryptocurrencies can be nerve-wracking for someone just starting in the trading world. It is only natural for you to have a lot of questions or concerns, which is why Bitsoft 360 has a customer service center that is open around the clock to ensure that all of your needs are met at all times and that you are never in the dark about anything.

In addition to this, there are a great many Bitsoft 360 user testimonials available online. These users have expressed their contentment with the trading capabilities of Bitsoft 360 and the profits it has generated for them. The following portions of this review of Bitsoft 360 will focus on various other aspects that contribute to the product’s overall legitimacy.

How to Use BitSoft360

Traders who want to begin using Bitsoft360 can get started by following these steps:

Join platform

To get started, go to the Bitsoft360 website in your web browser. The details of the traders, including their full names, phone numbers, and email addresses, will need to be entered.

After this is finished, the platform will transfer the trader to a broker, where the trader can access their account.

Make Deposit

Traders have various options for depositing funds into their Bitsoft360 accounts, including bank transfers, card payments, and direct cryptocurrency deposits.

Remember that the minimum deposit is $250; if you are a beginner trader, you should only trade with this amount.

Verify ID

Because there is a verification process for your protection, you must ensure the information you fill in is correct.

Live Trading Begins

Investors are given the ability to set their parameters using Bitsoft360. If investors have activated the automated mode, the algorithm will scan the market according to the desired parameters and open trades on their behalf.

FAQs

Do Any Celebrities Endorse BitSoft360?

Bill Gates and Richard Branson, recognized for their entrepreneurship, may be interested in cryptocurrency. A recent study showed that celebrities like Deborah Meaden of Dragon’s Den advocate cryptocurrencies on social media even if they are not associated with them professionally or in any other capacity, implying that riches can be accumulated with this new technology. No evidence links Bitsoft 360.

Does Elon Musk Or Any Corporation (Like Tesla) Use BitSoft360?

Elon Musk has publicly endorsed cryptocurrency. Companies like Tesla are trading cryptocurrencies, an alternative wealth store. They don’t use Bitsoft 360, though.

About Peter Knight PRO INVESTOR

Peter Knight worked as the Chief Technology Officer for Global Collect. Peter Knight has invested in Bill.com, known as Series E – Bill.com, and is estimated to be worth over $38 million. As a pro-investor, however, there is no record of him investing in or endorsing Bitsoft 360.

Bitsoft 360 Tesla

As an automobile manufacturer, Tesla is one of the few multinational corporations that has invested in cryptocurrency, Bitcoin. Some headlines in several false news articles suggest that Tesla has sold off its bitcoin holdings and is now investing in the Bitsoft 360 platform. There is, however, no evidence to support this claim.

Bitsoft 360 Bill Gates

The one-time richest man in the world and tech billionaire Bill Gates has been the subject of various speculations, but a cryptocurrency-related one is unlikely to be one of them. Bill Gates constantly shows his aversion to currency; it does not look like that will change in the future. There is no chance that he has any investment in Bitsoft 360.

Bitsoft 360 Elon Musk

There is no record of Elon Musk endorsing or trading with Bitsoft 360.

Bitsoft 360 Jeff Bezos

Jeffrey Preston Bezos is an American entrepreneur, investor, media proprietor, and commercial astronaut, in addition to being a computer engineer and having a background in engineering. He started Amazon, is now serving as executive chairman, and was previously president and CEO. Yes, Jeff Bezos is many things; he has not publicly declared, nor is there a record of him investing in Bitsoft 360. Any of such claims is a scam.

Bitsoft 360 Peter Jones

Peter Jones is a Dragons Den panellist. He is known for his love of tech projects and doesn’t shy away from funding tech companies when such needs arise. However, there is no confirmation of any speculation that this panellist funds or endorses Bitsoft 360.

Bitsoft 360 Dragons Den

Dragons Den is a TV program where entrepreneurs pitch their ideas to multimillionaires hoping to get investments. The investors are fans of technology and cryptocurrency innovations. There have been certain rumours that they invested in Quantum AI, but at the time of writing this review, there wasn’t any truth to this story.

Bitsoft 360 Amazon Prime

According to recent reports, Amazon is preparing to accept bitcoin as payment. Following this development, the corporation intends to begin providing support for other major cryptocurrencies. There is, however, no mention of Amazon Prime and Bitsoft 360.

The Verdict

When all of the information in this Bitsoft 360 review is considered, it can be stated with absolute certainty that the Bitsoft 360 trading platform will provide any user with an exceptional experience due to its many one-of-a-kind features. New users interested in making money through cryptocurrency trading can unlock a world of potential with the assistance of Bitsoft 360. Out of all the Bitsoft 360 reviews, this review has covered all the important bases.

As a result, we think that Bitsoft 360 would be an excellent choice for any trader interested in entering the cryptocurrency market. After creating an account and completing the steps outlined in the previous section, you can immediately claim your license. We strongly suggest that you make use of the current market conditions and make use of Bitsoft 360 so that you can maximize the amount of cryptocurrency money you make. We hope that by the time you’ve finished reading this Bitsoft 360 review, you will better understand how to trade using the Bitsoft 360 trading robot.