Bitcoinner Review Legit Crypto Trading Platform?

Official Bitcoinner Registration

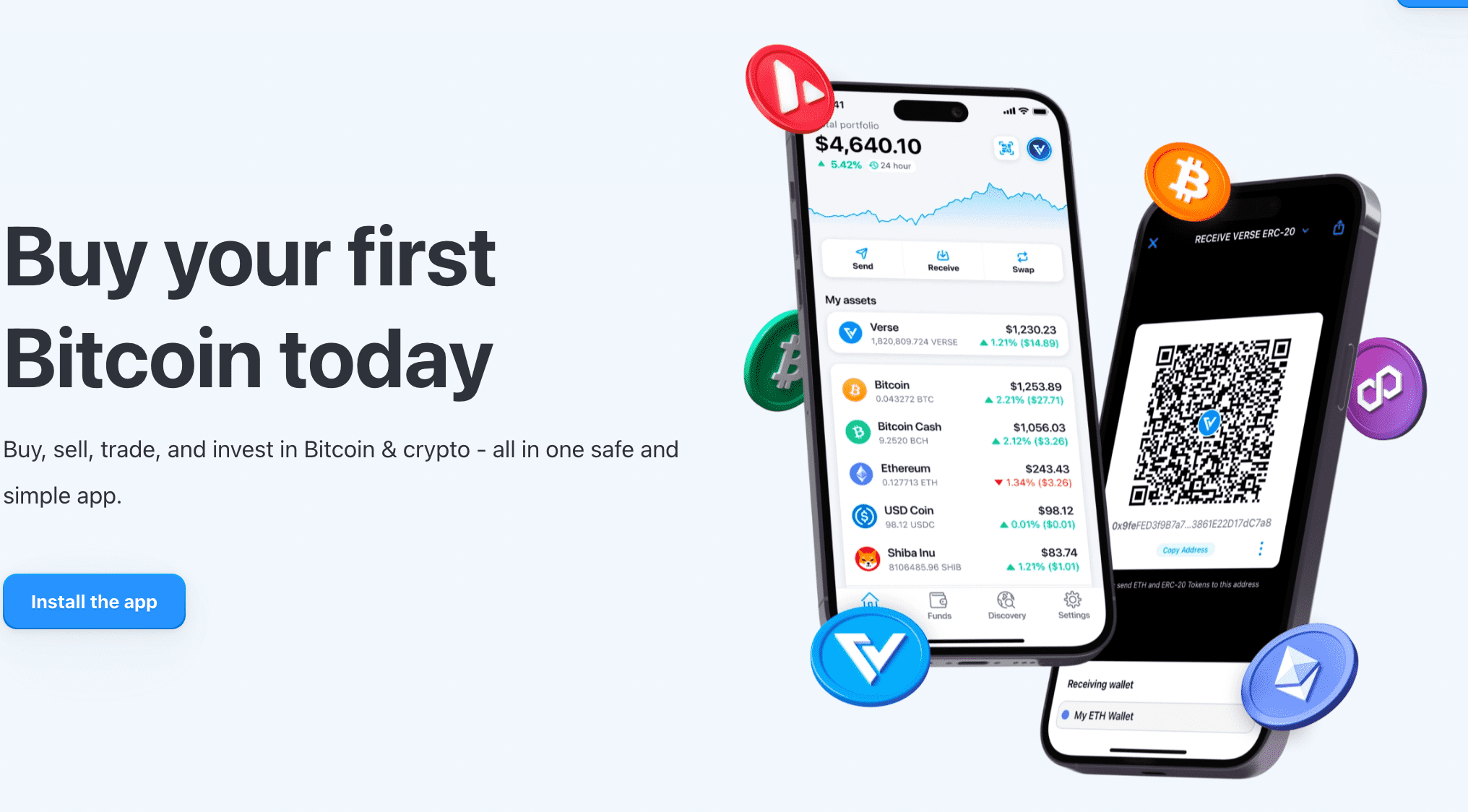

As an avid investor in the cryptocurrency market, I’m always on the lookout for new trading platforms that offer promising opportunities. Recently, I discovered Bitcoinner, a platform claiming to revolutionize crypto trading.

Intrigued by its features and potential, I decided to delve deeper. In this article, we’ll explore the legitimacy of Bitcoinner, including its advanced market analysis capabilities, user-friendly interface, and strategic trading options.

Join me as we uncover whether Bitcoinner is a legitimate crypto trading platform that can help you achieve your investment goals.

Bitcoinner Highlights

Robot Type Robot Type | Crypto Trading Robot |

Minimum Deposit Minimum Deposit | $250 |

Is It a Scam or Legit? Is It a Scam or Legit? | Legit |

Withdrawal Timeframe Withdrawal Timeframe | 24 hours |

Supported Cryptocurrencies Supported Cryptocurrencies | BTC, ETH, LTC, XRP |

Supported Fiats Supported Fiats | USD, EUR, GBP |

Leverage Leverage | 5000:1 |

Social Trading Social Trading | Yes |

Verification required Verification required | Introductory Phone Call / KYC |

Bitcoinner

Bitcoinner is a legitimate crypto trading platform that can help you achieve your investment goals.

Price: 250

Price Currency: USD

Operating System: Web-based, Windows 10, Windows 7, Windows 8, OSX, macOS, iOS, Android 7.1.2, Android 8.1, Android 9.0, Android 10.0, Android 11.0, Android 12.0, Android 13.0

Application Category: Finance Application

5

Pros

- Advanced crypto trading platform.

- No withdrawal or deposit fees.

- 24/7 customer service.

- Demo account available for beginners.

- Accessible on any device with internet connection.

Cons

- Lack of information about the creators.

- $250 minimum deposit.

Key Takeaways

- Bitcoinner is an advanced crypto trading platform that claims to have a success rate of 98.4%.

- The platform employs trading robots and uses artificial intelligence to analyze charts and execute trades based on predetermined strategies.

- It offers a user-friendly interface, and advanced market analysis, and supports a wide range of cryptocurrencies for trading.

- The minimum deposit required to start trading on Bitcoinner is $250, and the platform provides customer support through various channels.

Platform Overview: Type of Platform, Minimum Deposit, and Claimed Success Rate

Based on the knowledge provided, a minimum deposit of $250 is required to start trading on the Bitcoinner platform. This minimum deposit is a standard requirement for many trading platforms and serves as the minimum capital needed for trading on the platform. It’s important for investors to be aware of this requirement before getting started.

Additionally, for beginners, the importance of a demo trading account can’t be overstated. It allows them to practice trading strategies without risking real money, gaining valuable experience and confidence.

In the case of Bitcoinner, artificial intelligence plays a crucial role in analyzing trading charts. By using advanced algorithms, it can analyze market data around the clock and execute trades based on predetermined strategies, increasing the accuracy and efficiency of the trading process.

Supported Cryptocurrencies: Bitcoin, Ethereum, XRP, Cardano, Fantom, and More

I personally find it exciting that Bitcoinner supports a wide range of cryptocurrencies such as Bitcoin, Ethereum, XRP, Cardano, Fantom, and many more. This offers investors a diverse portfolio and opportunities for potential gains.

Here are the pros and cons of investing in supported cryptocurrencies:

Pros:

- Potential for high returns: Cryptocurrencies have shown the potential for significant price appreciation.

- Diversification: Investing in multiple cryptocurrencies spreads the risk and reduces exposure to a single asset.

- Innovation: Many supported cryptocurrencies are at the forefront of technological advancements, offering unique investment opportunities.

Cons:

- Volatility: Cryptocurrencies are known for their price volatility, which can result in rapid gains or losses.

- Regulatory risks: Regulatory changes or crackdowns on cryptocurrencies can impact their value and market stability.

- Lack of intrinsic value: Unlike traditional assets, cryptocurrencies derive their value from market demand, making them susceptible to sentiment and speculation.

The benefits of using artificial intelligence (AI) in crypto trading include:

- Enhanced analysis: AI can analyze vast amounts of data and identify patterns that humans may miss, enabling more informed trading decisions.

- Automation: AI-powered trading bots can execute trades swiftly, taking advantage of market opportunities 24/7.

- Risk management: AI algorithms can be programmed to set stop-loss and take-profit orders, helping to manage risk effectively.

Overall, investing in supported cryptocurrencies offers potential rewards but comes with risks. Utilizing AI technology in crypto trading can provide valuable insights and automation, but careful consideration of market conditions and risk management is essential.

Trading Strategy: Adjusting Stop-Loss and Take-Profit Settings

One can maximize their trading strategy by adjusting stop-loss and take-profit settings to manage risk effectively. By optimizing these settings, traders can protect their investments and take advantage of profitable opportunities in the market.

| Trading Strategy Optimization | Risk Management Techniques |

|---|---|

| Use trailing stop-loss orders | Diversify portfolio |

| Set realistic profit targets | Implement position sizing |

| Utilize technical indicators | Monitor market volatility |

Implementing a trailing stop-loss order allows traders to protect their gains by automatically adjusting the stop-loss level as the price of the asset moves in their favor. Setting realistic profit targets helps traders to lock in profits and avoid unnecessary risks. By utilizing technical indicators, traders can make informed decisions based on market trends and patterns. Diversifying the portfolio reduces the overall risk exposure by investing in different assets.

Implementing position sizing ensures that the risk per trade is controlled and aligned with the trader’s risk tolerance. Lastly, monitoring market volatility helps traders adjust their risk management techniques accordingly. Overall, adjusting stop-loss and take-profit settings is crucial for trading strategy optimization and effective risk management.

User-Friendly Interface: Easy Navigation for All Experience Levels

The user-friendly interface of Bitcoinner ensures easy navigation for investors of all experience levels. This feature provides several benefits in crypto trading, particularly for beginners.

- Intuitive Design: The platform’s interface is designed with simplicity in mind, allowing users to easily navigate through the various features and functionalities. This reduces the learning curve and enables beginners to quickly grasp the basics of crypto trading.

- Clear Information Presentation: A user-friendly interface presents information in a clear and organized manner, making it easier for beginners to understand important details such as asset prices, trading charts, and account balances. This enhances decision-making and reduces the likelihood of errors.

- Streamlined Processes: Easy navigation streamlines the trading process, allowing beginners to quickly execute trades, set stop-loss and take-profit levels, and monitor their portfolio. This ensures a smoother and more efficient trading experience, boosting confidence and encouraging further engagement.

Advanced Market Analysis: Finding Trading Opportunities Around the Clock

During my trading journey, I have discovered that advanced market analysis uncovers countless trading opportunities around the clock. By using advanced market analysis techniques, such as AI analysis, traders can identify profitable trading signals and make informed decisions.

This type of analysis involves analyzing market data, charts, and indicators to predict market movements and trends. Through AI analysis, traders can gain insights into market patterns and make more accurate predictions.

This enables them to enter and exit trades at the most opportune times, maximizing their profits. AI analysis also helps in identifying potential risks and managing them effectively. By incorporating advanced market analysis into their trading strategies, traders can increase their chances of successful and profitable trading.

| Advantages | Challenges |

|---|---|

| 1. Identifying profitable trading signals | 1. Complexity of AI analysis |

| 2. Predicting market movements | 2. Need for continuous updates |

| 3. Maximizing profits | 3. Potential for false signals |

| 4. Managing risks effectively | 4. Dependency on accurate data |

| 5. Enhancing trading strategies | 5. Overreliance on AI analysis |

Using advanced market analysis for successful trading is a valuable tool for traders looking to increase their profitability and make informed trading decisions. By leveraging AI analysis and utilizing the insights gained from market data, traders can stay ahead of the market and capitalize on trading opportunities. It is important to note that while advanced market analysis can provide valuable insights, it should not be the sole basis for trading decisions.

Traders should also consider other factors such as market trends, news events, and risk management strategies. By combining advanced market analysis with a comprehensive trading approach, traders can improve their trading performance and achieve their financial goals.

Multi-Asset Support: Buying and Selling a Large Number of Tokens

I find it convenient to navigate the Bitcoinner platform for buying and selling a large number of tokens with its multi-asset support. The platform offers several pros and cons for multi-asset trading, and there are strategies that can be employed to maximize profits.

Pros of Multi-Asset Trading on Bitcoinner:

- Diversification: Multi-asset trading allows for diversifying investments across different tokens, reducing risk.

- More Opportunities: With a large number of supported cryptocurrencies, there are more trading opportunities available.

- Flexibility: Investors can choose from a variety of assets based on their preferences and market conditions.

Cons of Multi-Asset Trading on Bitcoinner:

- Higher Complexity: Managing multiple assets requires more time and effort for research and analysis.

- Increased Risk: Trading multiple assets can expose investors to higher volatility and potential losses.

- Market Knowledge: It’s important to have a good understanding of each asset to make informed trading decisions.

Strategies for Maximizing Profits with Multi-Asset Trading on Bitcoinner:

- Research and Analysis: Conduct thorough research on each asset to identify trends and potential opportunities.

- Risk Management: Set appropriate stop-loss and take-profit levels to manage risk and protect profits.

- Portfolio Allocation: Allocate investments across different assets based on their potential returns and risk levels.

Overall, multi-asset trading on Bitcoinner can offer diversification and more trading opportunities, but it requires careful research, risk management, and portfolio allocation strategies to maximize profits.

Security Measures: Protecting Identity and Assets

One important aspect of security measures is the use of strong passwords to protect both identity and assets.

When it comes to automated trading platforms like Bitcoinner, ensuring the security of user funds and personal information becomes crucial. Bitcoinner prioritizes the protection of user funds by implementing SSL encryption on its website. Additionally, the platform mentions the implementation of Know Your Customer (KYC) measures, which further safeguards user deposits.

While Bitcoinner claims to have a success rate of 98.4%, it’s important to note that this accuracy rate lacks independent verification. However, the platform positions itself as one of the highest in accuracy within the crypto industry.

Overall, Bitcoinner aims to provide a secure trading environment for its users, but it’s essential for individuals to conduct their own research and exercise caution when using any automated trading platform.

Minimum Deposit and Customer Support: Considerations and Assistance

While considering the minimum deposit requirement, it’s important to know that Bitcoinner offers customer support to registered users. Responsive customer support is also of utmost importance. With Bitcoinner, registered users have access to customer support through telephone, email, or live chat. This ensures that any queries or concerns can be addressed promptly, providing peace of mind and assistance when needed.

When deciding on the minimum deposit amount, there are several considerations to keep in mind:

- Personal Financial Circumstances: It’s crucial to assess your own financial situation and determine how much you can comfortably afford to invest.

- Investment Goals: Consider your investment goals and the level of risk you’re willing to take. A higher deposit may offer more trading opportunities but also carries more risk.

- Platform Features: Evaluate the features and benefits offered by Bitcoinner. Determine if the minimum deposit aligns with the value you expect to receive.

Conclusion

After thoroughly examining Bitcoinner, it’s evident that this platform offers a promising opportunity for cryptocurrency investors.

With a claimed success rate of 98.4%, traders can feel confident in the accuracy of its market analysis capabilities.

Additionally, the user-friendly interface and multi-asset support make it accessible for investors of all levels.

It’s worth noting that Bitcoinner supports a wide range of cryptocurrencies, including Bitcoin, Ethereum, XRP, Cardano, and Fantom, allowing for diverse trading options.

Overall, Bitcoinner proves to be a legitimate crypto trading platform with significant potential for investors.

FAQ

How Does Bitcoinner’s Trading Strategy Work and Can Users Adjust Stop-Loss and Take-Profit Settings?

Bitcoinner’s trading strategy utilizes trading robots and artificial intelligence to analyze charts and execute trades. Users can adjust stop-loss and take-profit settings to manage risk. The level of risk involved depends on individual trading decisions.

Is the User Interface of Bitcoinner User-Friendly and Suitable for Investors of All Experience Levels?

Yes, the user interface of Bitcoinner is user-friendly and suitable for investors of all experience levels. It allows for easy customization of trading strategies and risk management.

How Does Bitcoinner Conduct Advanced Market Analysis to Find Trading Opportunities?

Bitcoinner conducts advanced market analysis using artificial intelligence (AI). It utilizes key indicators to identify trading opportunities. The role of AI in this process allows for accurate and efficient analysis, enhancing the platform’s ability to find profitable trades.

Does Bitcoinner Support Trading of a Wide Range of Tokens, in Addition to Popular Cryptocurrencies Like Bitcoin and Ethereum?

Bitcoinner supports trading of a wide range of tokens, making it beneficial for diversifying crypto investments. Compared to other platforms, it offers advanced market analysis, user-friendly UI, and 24/7 customer support for efficient token trading.

What Security Measures Does Bitcoinner Have in Place to Protect Users’ Identity and Assets?

Bitcoinner has robust security measures in place to protect users’ identity and assets. They prioritize SSL encryption and implement KYC measures. Additionally, their customer support is effective and available through various channels.