Trader Flarex 0.8 (8A) with Average Day Range: Comprehensive Review of Trade Flarex 8000

Updated

Introduction to Trader Flarex 8A (model 8000)

Trader Flarex 0.8 is a semi-automated trading platform that focuses on LAC; according to public sources, the project was recently introduced and offers traditional trading features combined with the latest automation and AI technologies.

With its automated capabilities, Trade Flarex 8000 project AI algorithms empower traders to make informed investing decisions. It’s like having a personal analyst right next to you while trading the financial markets, especially with its integration with the most popular technical indicators like the Average Day Range.

Official Trader Flarex Registration

Please note that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance will be profitable.

Key features and benefits of Trader Flarex 8000

Pros

- A mobile trading app

- Commission-free trading

- Regulated by top-tier authorities

- Multiple account types

- Tight spreads

Cons

- No social trading features

- Not available in the US

- Limited cryptocurrency options

- Higher spreads on less liquid assets

- Potential withdrawal delays during peak times

*According to public sources and the platform’s website

Trader Flarex 8000 Overview (Including versions 8A, and 0.8)

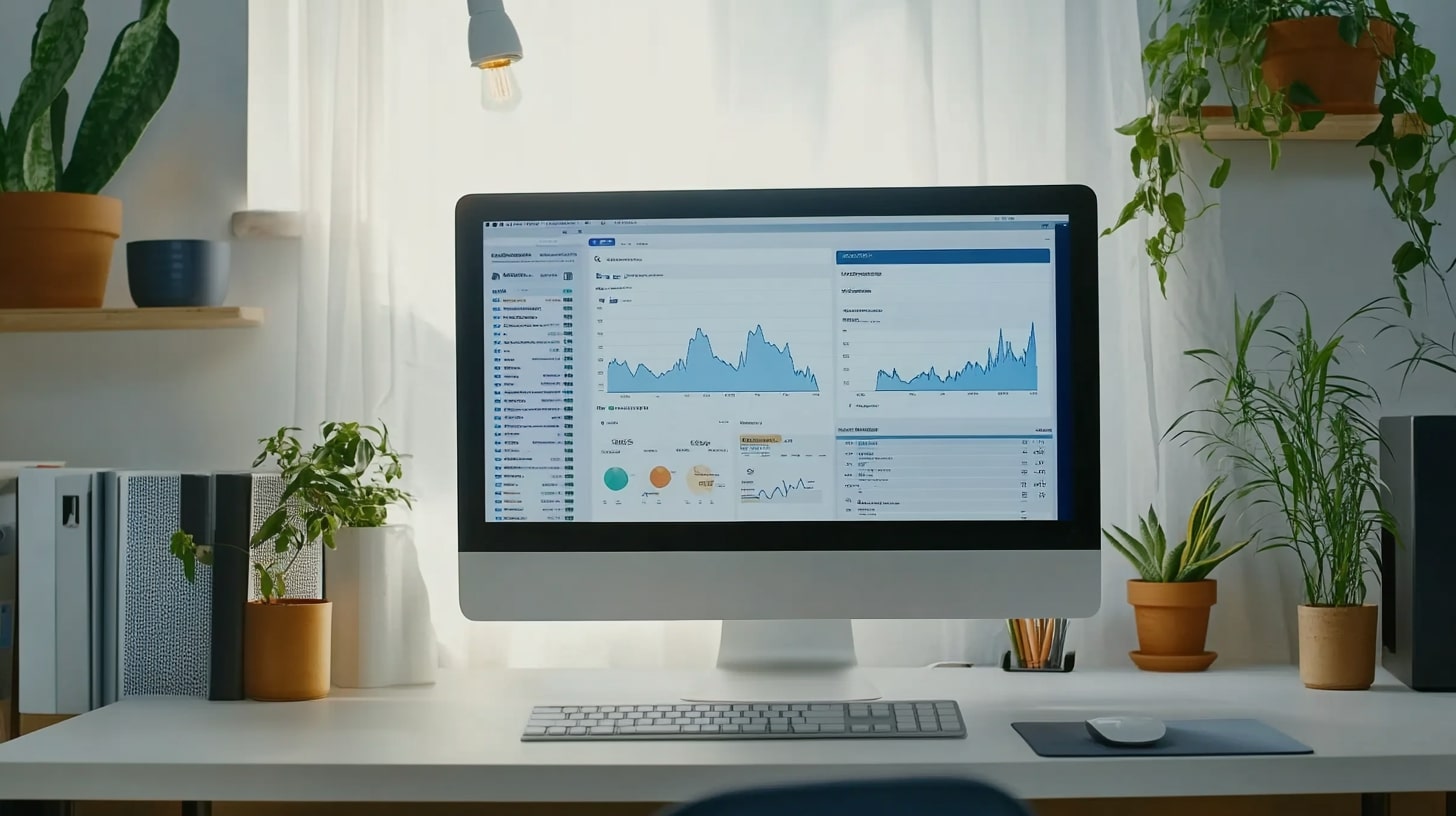

Trader Flarex 8000 uses the Average Day Range indicator to trade LAC and other assets. When you’re trading Lithium Americas Corp (LAC) with the Average Day Range just look at how much the stock moves in a day. If the range is getting bigger it means more volatility and bigger price swings which could mean more trading opportunities. If the range is shrinking the stock isn’t moving as much so things might be slowing down. It’s a good way to set targets and stop-loss levels. It uses artificial intelligence to assess its probability of success by analysing similar patterns from the past before making a trade.

Is Trader Flarex for you?

Trader Flarex 8A and its latest 0.8, and Trade Flarex 8000 versions are suitable for:

- Beginners who need a guiding hand in the trading world.

- Experience traders who are seeking a project that offers AI-generated insights.

- Traders focused on LAC and other major trading symbols.

- Individual investors and financial enthusiasts.

- Anyone who has a smartphone and/or computer with a high internet connection.

The financial world can be overwhelming due to its complexities, extensive fundamental data, technical jargon, and wide range of financial information and trading instruments. Trade Flarex 8000 offers a solution with its robust AI system and features.

Trader Flarex 0.8, including versions 8A, and 8000 focuses on LAC:

Lithium Americas Corp (LAC)

Lithium Americas Corp. (LAC) is a company focused on lithium exploration and development which makes it a bet on the future of electric vehicles (EVs) and battery technology. They own the Thacker Pass project in Nevada one of the largest lithium deposits in the U.S. With demand for lithium growing LAC seems like a company that could take off. But before jumping in let’s break things down.

LAC has had a rough few months. Over the past three months it’s down 28.10% but if you zoom out it’s up 30.74% over six months. That kind of movement tells us one thing—this stock is volatile.

Right now, it’s trading at $3.02 which is near its yearly low of $2.97. The one-year price target is $5.15 meaning analysts think it could climb over 70% from here. That sounds promising but there are risks too.

Why LAC Might Be a Good Investment

- Rising Lithium Demand – The world is shifting toward electric vehicles and renewable energy storage and lithium is a key ingredient in batteries.

- Thacker Pass Potential – This is one of the largest lithium deposits in the U.S. If production scales up successfully LAC could become a major player.

- Strong Cash Reserves – The company has a quick ratio of 13.65 and a current ratio of 13.88 which means it has plenty of cash to cover its short-term needs.

- Low Debt – With only $4.3 million in total debt the company isn’t weighed down by loans like many other mining companies.

Big Risks to Watch Out For

- No Revenue Yet – LAC is still in the early stages meaning it’s not making money yet. Everything depends on future lithium production.

- Burning Through Cash – The company had negative free cash flow of $179.6 million meaning it’s spending more than it’s bringing in.

- Stock Price Swings – If you invest in LAC expect big ups and downs. The stock has been all over the place in the last year.

- Lithium Prices Could Drop – If the lithium market cools off LAC’s value could take a hit.

So, should you buy? If you believe in the long-term future of lithium and don’t mind short-term volatility LAC could be a solid long-term investment. But if you’re looking for a stable company that’s already making money this might not be the best pick.

Average Day Range on Trader Flarex 8000

How to Trade LAC Using the Average Day Range

Because LAC moves a lot using technical indicators can help decide when to buy or sell. One useful tool is the Average Day Range (ADR).

What is the Average Day Range?

ADR measures how much a stock moves on average in a single trading day. It looks at the difference between the daily high and low price over a set number of days (usually 14).

How Can It Help with LAC?

- High ADR = More Volatility – If the ADR is high LAC is making big daily moves which is great for short-term trading.

- Low ADR = Less Movement – If ADR drops the stock is more stable making it better for long-term investing.

- Using ADR for Stop-Loss Levels – If you’re trading LAC knowing its average daily movement can help you set smart stop-loss orders, so you don’t get caught in a bad drop.

Since LAC has a history of big price swings traders can use ADR to time their entries and exits while long-term investors can wait for a dip before buying in.

Lithium Americas is a high-risk high-reward stock. The company has potential but it’s still in development mode meaning it’s not making profits yet.

If you’re looking for a long-term investment and believe in the lithium industry buying LAC while it’s near its yearly low could be a smart move. But if you want something more stable you might want to wait until the company starts producing revenue.

For traders the Average Day Range (ADR) can be a useful tool to catch short-term price swings. Since LAC moves a lot tracking its daily range can help identify the best times to buy and sell.

FAQ

Currently, Trader Flarex does not offer a dedicated mobile app. However, the platform is designed with a highly responsive and user-friendly interface, ensuring it adapts seamlessly to any device. This means you can effortlessly access and navigate Trader Flarex on smartphones, tablets, and computers, providing a consistent and efficient trading experience across all your devices.

To register with Trader Flarex, simply visit their official website, click on the “REGISTER SECURELY” button, and fill in the required information such as your name and email. After verifying your email through a link sent to you, complete any additional identity verification if needed, deposit your initial funds, and you’re ready to start trading. It’s a quick and easy process to get you trading in no time.

According to the official website, using Trade Flarex comes at no cost. However, traders are required to fund their accounts with a minimum of $250 to begin trading, which is fully utilised as trading capital.

Our Conclusion

Trader Flarex 8A and its latest, Trader Flarex 8000 and Trade Flarex 0.8 versions offer an exciting mix of AI-powered insights, advanced charting capabilities, and user-friendly design, making it an excellent choice for traders at any level.

Please be aware that any types of trading involve risk and may lead to losses, you should therefore not invest funds that you cannot afford to lose. Always conduct your own research, understanding the risks, and plan your investments accordingly.